When Should I Receive My W2 2025

When Should I Receive My W2 2025. If you receive your tax refund by direct deposit, you may see irs treas 310 listed in the transaction. In most cases, you should receive any 1099 form by the end of january.

A 1099 form is used to report income that isn’t directly earned through an employer. 31 each year, or the next business day if the end of the month falls on a weekend.

The irs has announced that the deadline for employers to issue their w2 forms to employees for the 2025 year is on.

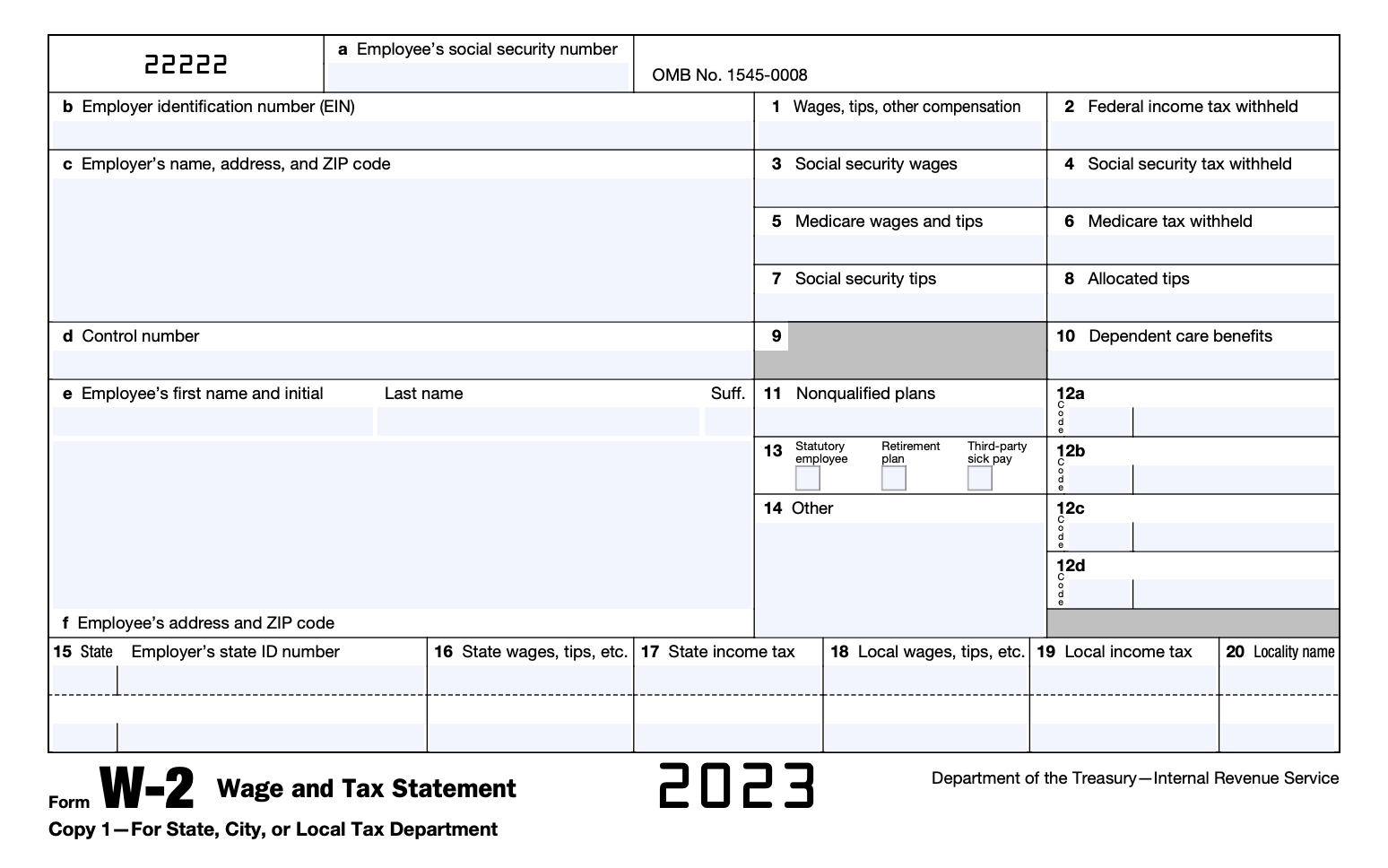

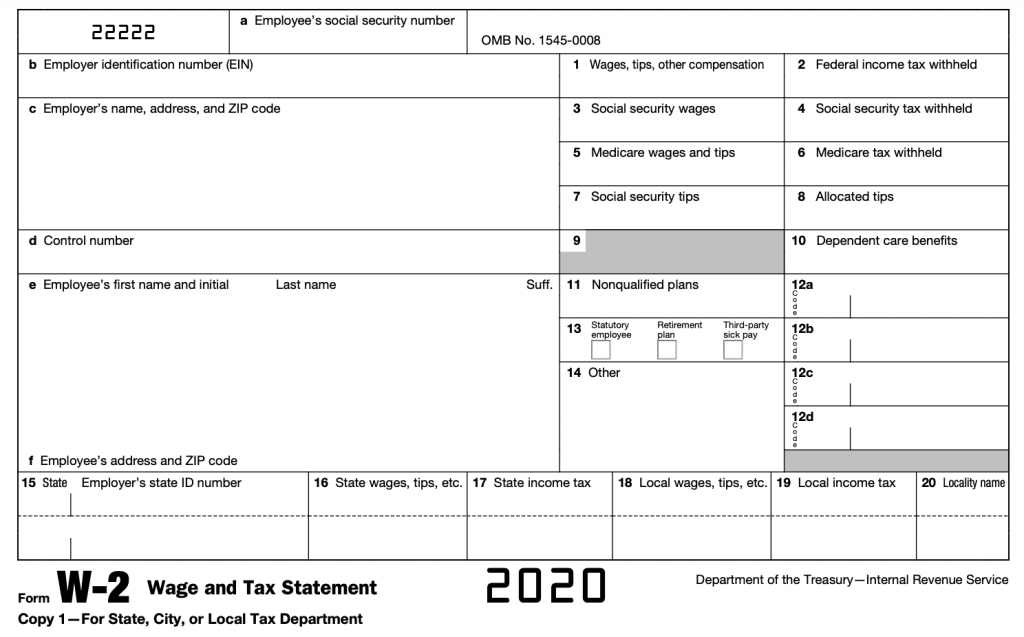

Employees use it to report payroll taxes paid, and the irs uses it to determine how much is owed in taxes, if any, or if employees are due a refund.

W2 Form 2025 Lucie Imojean, When can you expect to receive your w2? Ask your employer to correct the error.

2025 General Instructions For Forms W2 And W3 Josey Mallory, In most cases, you should receive any 1099 form by the end of january. On february 21, 2025, the irs made significant changes to the electronic filing requirements that will take effect in 2025.

Understanding Your IRS Form W2, If your employer doesn't correct it by the end of february, you should either: On february 21, 2025, the irs made significant changes to the electronic filing requirements that will take effect in 2025.

Form W2 Everything You Ever Wanted To Know, Ask your employer to correct the error. The new threshold is effective for information returns required to be filed in calendar years beginning with 2025.

How To Fill Out Form W2 Detailed guide for employers (2025), In most cases, you should receive any 1099 form by the end of january. Employees use it to report payroll taxes paid, and the irs uses it to determine how much is owed in taxes, if any, or if employees are due a refund.

What Is Form W2? An Employer's Guide to the W2 Tax Form Gusto, When can you expect to receive your w2? Some exceptions to this rule may.

What is a W2 Form? Wage and Tax Statement Guide, Ask your employer to correct the error. The new threshold is effective for information returns required to be filed in calendar years beginning with 2025.

The Ultimate Guide to Reading and Understanding Your W2 Form Lives On, A 1099 form is used to report income that isn't directly earned through an employer. The new threshold is effective for information returns required to be filed in calendar years beginning with 2025.

¿Qué es un número de control W2? Los Basicos 2025, A 1099 form is used to report income that isn't directly earned through an employer. Dfas is committed to providing multiple options to help you obtain.

Understanding Your Forms W2, Wage & Tax Statement, 31 each year, or the next business day if the end of the month falls on a weekend. Washington — the internal revenue service today suggested taxpayers who filed or are about to file their 2025 tax return use the irs tax.