Mileage Reimbursement 2025 California

To calculate mileage reimbursement in california, multiply the total number of business miles driven by the irs standard mileage rate for the year. And reimbursement for expenses such as mileage and.

You can use this mileage reimbursement calculator to determine the deductible costs associated with running a vehicle for medical, charitable, business, or moving. California follows the irs standard mileage rates, with the 2025 rate set at 67 cents per mile.

To calculate mileage reimbursement in california, multiply the total number of business miles driven by the irs standard mileage rate for the year.

Mileage Reimbursement 2025 California Calculator Harri Klarika, Learn how the irs rate and other rules apply in the golden state. Beginning on january 1, 2025, the millage rate for reimbursement for business use will increase to 67 cents per mile.

.png)

California Mileage Reimbursement Law 2025 Gwenny Shelbi, Each year, the irs sets a mileage reimbursement rate. In california, employers are required to fully reimburse you when you use your personal vehicles for business purposes.1 there are 4 ways to calculate the.

California Mileage Reimbursement Requirements Explained (2025), California, on tuesday, october 30, 2018. What are the california mileage reimbursement rules and rates in 2025?

2025 California Mileage Reimbursement Rate Deane Estelle, You can use this mileage reimbursement calculator to determine the deductible costs associated with running a vehicle for medical, charitable, business, or moving. Learn how the irs rate and other rules apply in the golden state.

Mileage Reimbursement Rate 2025 Shirl Marielle, What are the california mileage reimbursement rules and rates in 2025? Operate a privately owned vehicle on state business.

Mileage Reimbursment 2025 Minna Sydelle, Operate a privately owned vehicle on state business. Learn how the irs rate and other rules apply in the golden state.

What Is The 2025 Mileage Reimbursement Rate Janey Lisbeth, 67 cents per mile driven for business use, up 1.5 cents from 2025. Do california companies have to use the irs.

Журнал обслуживания автомобиля excel Word и Excel помощь в работе с, Find information about the types of mileage reimbursement in california, the 2025 california mileage rates and the records you'll need to keep to be reimbursed. How much is mileage reimbursement in california?

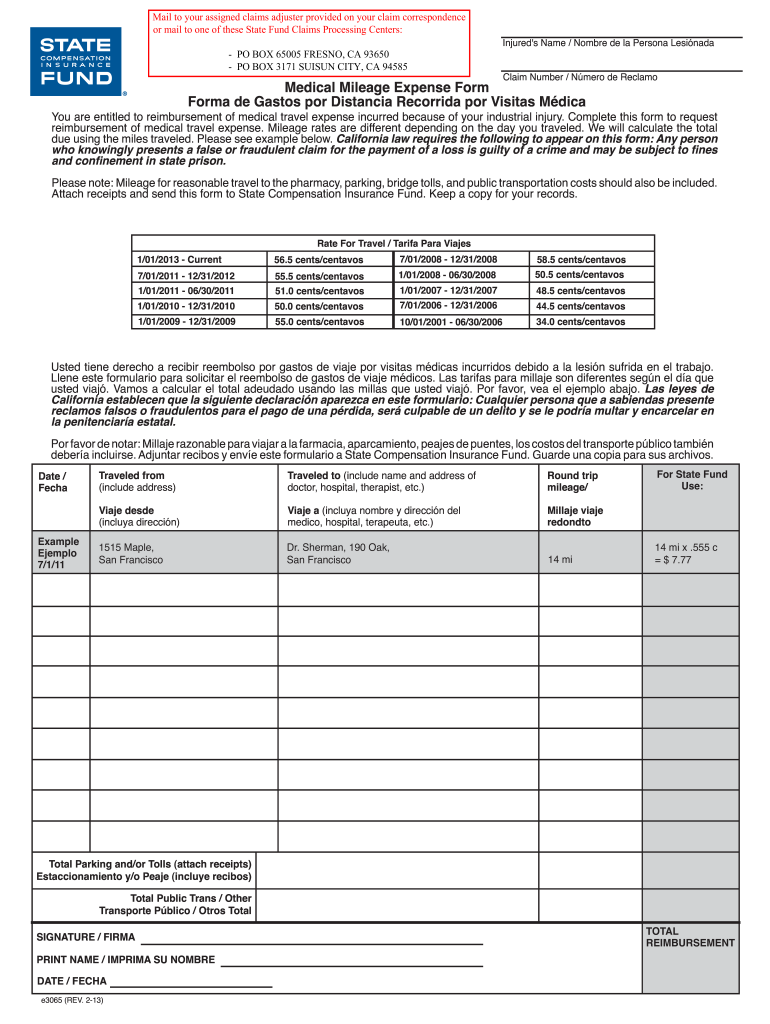

I a mileage form 2025 Fill out & sign online DocHub, Operate a privately owned vehicle on state business. What are the california mileage reimbursement rules and rates in 2025?

Auto Reimbursement 2025 Erika Jacinta, California, on tuesday, october 30, 2018. In california, employers are required to fully reimburse you when you use your personal vehicles for business purposes.1 there are 4 ways to calculate the.

You can use this mileage reimbursement calculator to determine the deductible costs associated with running a vehicle for medical, charitable, business, or moving.